Efficient Application Procedure

Simplified method for quicker start of your desired house journey, reducing documentation and waiting times.

Fill The Enquiry Form Now

Loan Suvidhaa simplifies the home loan process by offering expert guidance, personalised solutions, and seamless access to Canara Bank Home Loan, HDFC Home Loan, SBI Home Loan and all services. We ensure quick approvals and hassle-free documentation for a stress-free experience.

Simplified method for quicker start of your desired house journey, reducing documentation and waiting times.

Cutting-edge technology allows swift replies to applications, speeding up your house purchase with assurance and effectiveness.

Smooth journey from application to distribution, ensuring trust and minimal trouble throughout the borrowing process.

Round-the-clock support for inquiries, advice, and assistance, offering convenience and peace of mind to borrowers.

Access to favorable rates reduces long-term expenses, making homeownership more accessible and sustainable over the years.

Beneficial deductions on interest payments decrease taxable income, maximizing savings and financial efficiency for homeowners.

At Loan Suvidha, we understand the deep importance of owning a home and the significant financial factors involved. Our platform is carefully designed to help you & secure the perfect home loan from all banks (Canara Bank Home Loan, HDFC Bank Home Loan, Axis Bank and more) or all private firms that fits your specific needs and financial circumstances. Our team is very much efficient in making the application process easier, ensuring a smooth journey. With access to a wide range of resources and knowledge, our committed team offers personalised advice and assistance, whether you're a first-time purchaser or an experienced investor. By utilising our extensive network, we simplify the procedure, saving your time and energy.

We provide competitive interest rates starting at 8.55% p.a., one of the lowest rates in the market. Please also note that rates are subject to the markets.

Obtain Your Desired Loan Amount and Repay at Your Convenience. Extend Your Home Loan Tenure for Up to 30 Years.

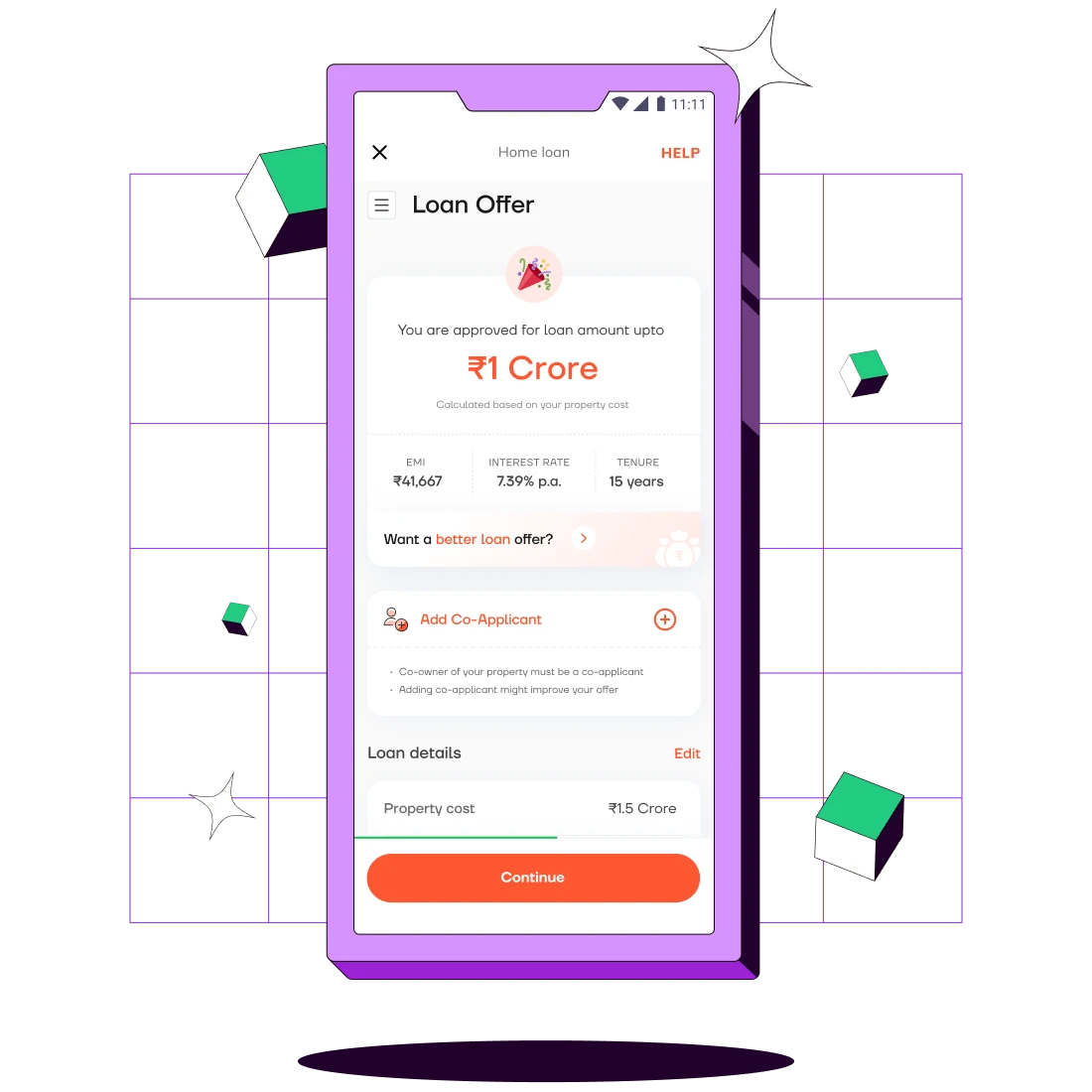

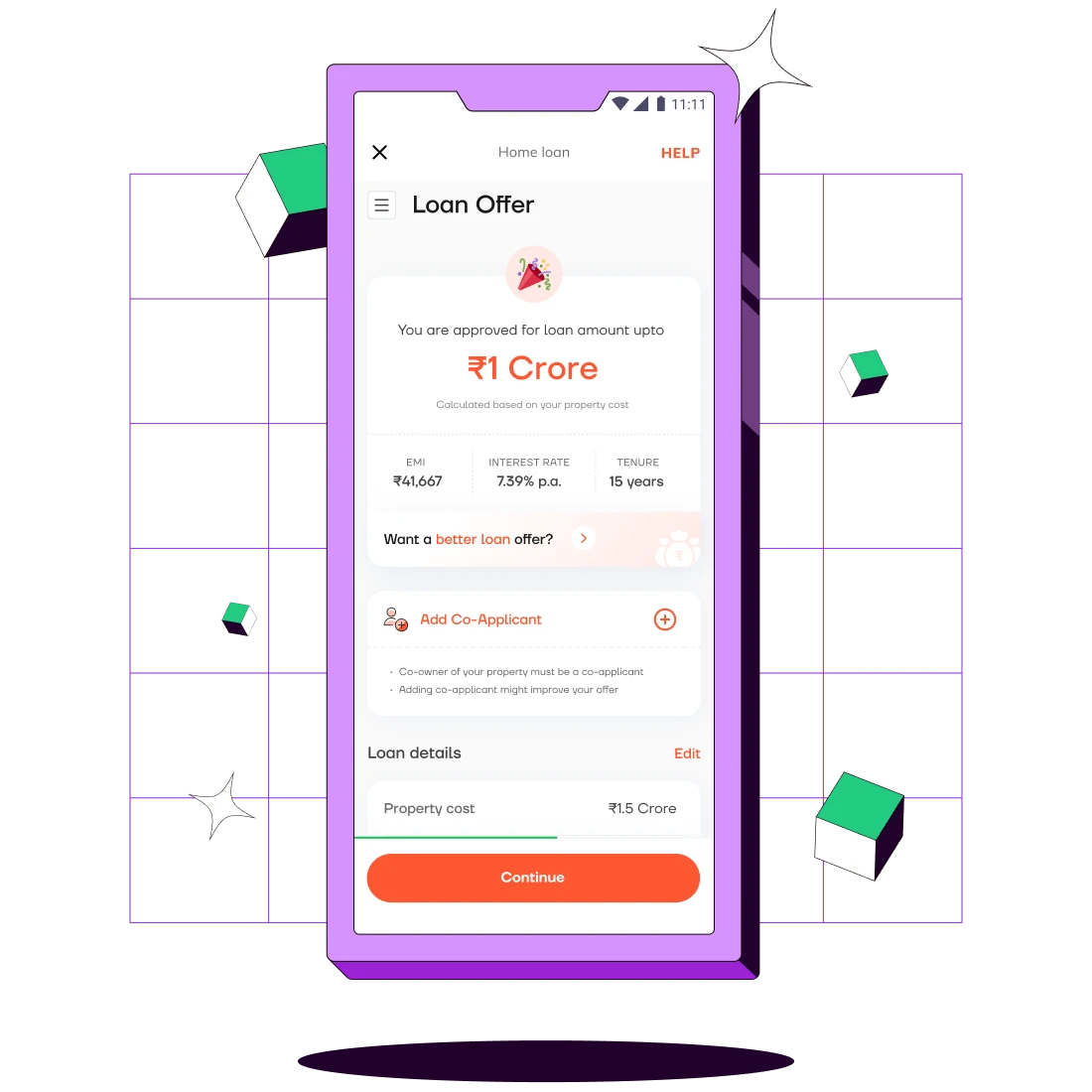

Receive an Instant Sanction Letter Upon Approval of Your Home Loan. Refer to the Sanction Letter for Clear Understanding of the Loan's Terms and Conditions.

While traditional lenders may take weeks to approve your loan, we can do it in few simple steps. Simply click on apply now and fill the form our expert team will process your loan application in few minutes.

No paperwork requirement. Our process of housing loan is completely paperless, from loan application to approval, ensuring a seamless quick journey for you.

We do not impose any processing fees. Additionally, you can pre-close your housing loan without incurring any extra charges, making it even more convenient for you.

Let's delve into how Loan Suvidha works to simplify the process of acquiring a home loan.

Gain access to a variety of loan choices at competitive rates from reliable lenders.

Enjoy a seamless process with easy-to-use tools and a user-friendly interface.

Easily submit loan applications through the Loan Suvidha website for increased efficiency.

Clear communication with borrowers, offering instant updates on application status for improved interaction.

Interest Rate: 8.55% p.a. onwards

Loan Amount: Up to Rs.5 crore

Tenure: Up to 30 years

Foreclosure Charges: Zero

| Particulars | For Salaried | For self-employed |

|---|---|---|

| Age Limit | 23 years to 70 years | 23 years to 70 years |

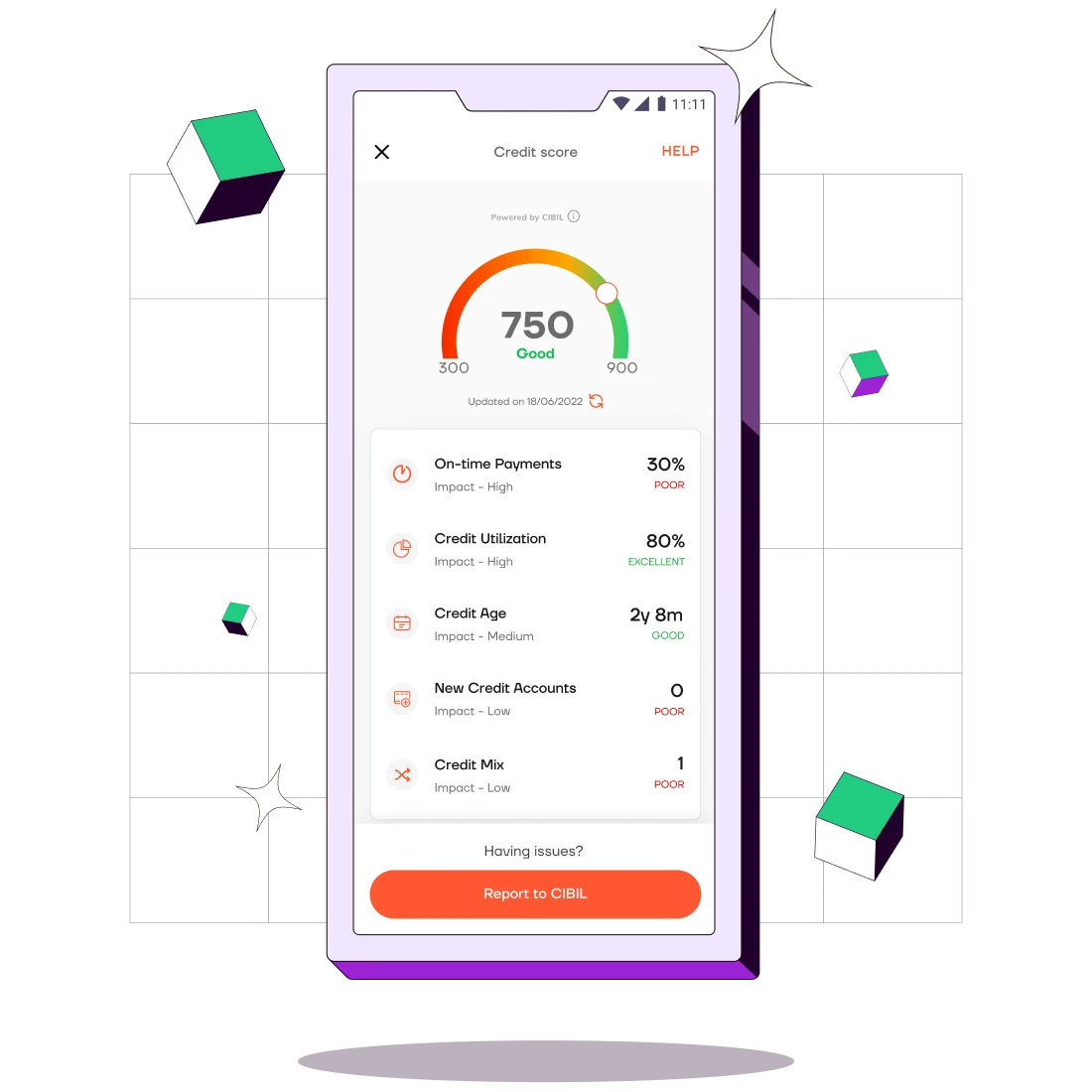

| Required Credit Score | 700 Or Higher | 700 Or Higher |

| Minimum Income Per Annum | Minimum 3Lac Per Annum | Minimum 5Lac Per Annum |

| Nationality | Indian, residing within the country | Indian, residing within the country |

Loan Suvidha provides round-the-clock assistance, competitive interest rates, tax advantages, and a simple loan procedure, ensuring trust, minimal trouble, convenience, and peace of mind for borrowers throughout the home loan process.

Loan Suvidha's eligibility criteria include age limits, required credit scores, work experience, minimum income per annum, and nationality requirements for both salaried and self-employed individuals, ensuring borrowers meet the necessary criteria for loan approval.

Applying for a home loan with Loan Suvidha is a simple three-step process: fill out an easy online form, upload your ID documents and bank statement, and receive instant money in your bank account, ensuring a hassle-free experience for borrowers.

Home loans offer financial support, flexible repayment options, tax benefits, and the opportunity to invest in a valuable asset, making homeownership a feasible and beneficial choice for individuals.

Loan Suvidha offers a simplified method for quicker initiation of the house buying journey, reducing documentation and waiting times, ensuring a smoother borrowing process for applicants.

Loan Suvidha utilizes cutting-edge technology to provide swift replies to loan applications, facilitating immediate loan approval and expediting the house purchase process with assurance and effectiveness.