Invest in ELSS

Fill The Enquiry Form Now

Optimizing Tax Benefits with ELSS Supported by Loan Suvidha

Understand The Significance of Investment in ELSS

ELSS investments, with Loan Suvidha assistance, are paramount for fostering financial growth, ensuring tax compliance, safeguarding wealth, securing health, providing peace of mind, and establishing long-term financial stability.

High Returns

An ELSS investment provides the potential for significant returns over the long term. By investing in the Equity Linked Savings Scheme (ELSS), you can benefit from the growth potential of the stock market while enjoying tax-saving advantages.

Zero Capital Gains Tax

Similar to certain mandatory general insurance policies, investing in ELSS offers tax benefits, specifically in the form of zero capital gains tax. This means that any profits earned from ELSS investments are not subject to capital gains tax, providing investors with a significant advantage.

Save Upto Rs 46,800

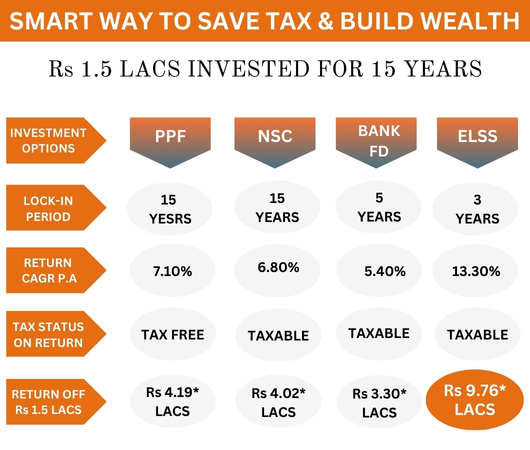

Just as health insurance covers medical expenses, investing in ELSS offers tax savings of up to Rs 46,800 under Section 80C of the Income Tax Act. By investing in Equity Linked Savings Scheme (ELSS), you can secure tax benefits while also building wealth for the future.

Benefits of Investing in ELSS

ELSS funds come with huge benefits. The most common reasons for investing in an ELSS fund are as follows

.png)

Tax Saving Investments

Select a loan assistance service with minimal waiting times, ensuring prompt access to financial support without unnecessary delays.

Read More

Long-Term Investment Options

Opt for loan assistance programs without co-payment requirements, avoiding additional financial burdens during the loan repayment process.

Read More.png)

High Returns In The Long Run

Look for loan assistance services that offer annual check-up facilities, promoting proactive financial health management.

Read More

The Discipline Of Investing

Choose a loan assistance service offering generous grace periods, providing flexibility and peace of mind during repayment periods.

Read MoreTestimonial

Frequently Asked Questions

Yes, Loan Suvidha assists investors in selecting the right ELSS funds based on their risk tolerance, investment horizon, and financial goals. We provide comprehensive analysis and recommendations to help investors make informed choices.

Loan Suvidha's ELSS investment approach is characterized by personalized guidance, thorough research, and a focus on long-term wealth creation. We prioritize the financial well-being of our clients and strive to deliver tailored solutions that meet their unique needs.

Getting started with ELSS investments through Loan Suvidha is simple. You can fill out our enquiry form with your details, and one of our experienced advisors will reach out to assist you. We'll guide you through the process, answer any questions you may have, and help you begin your journey towards financial growth and tax savings.

Loan Suvidha provides expert guidance and support to investors seeking to maximize benefits from Equity Linked Savings Scheme (ELSS) investments. We assist in selecting the right ELSS funds aligned with your financial goals, optimizing tax savings, and achieving long-term financial stability.

Loan Suvidha helps investors understand the tax-saving benefits offered by ELSS under Section 80C of the Income Tax Act, 1961. We provide guidance on maximizing tax savings of up to Rs 46,800 and ensure compliance with tax regulations.

Loan Suvidha offers personalized assistance and expertise in ELSS investments, ensuring that investors make informed decisions aligned with their financial objectives. With Loan Suvidha's support, investors can navigate the complexities of ELSS investments with confidence.